net investment income tax 2021 form

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Net investment income includes interest dividends annuities royalties certain rents and.

Line 76 Young Child Tax Credit YCTC Enter your Young Child Tax Credit from form.

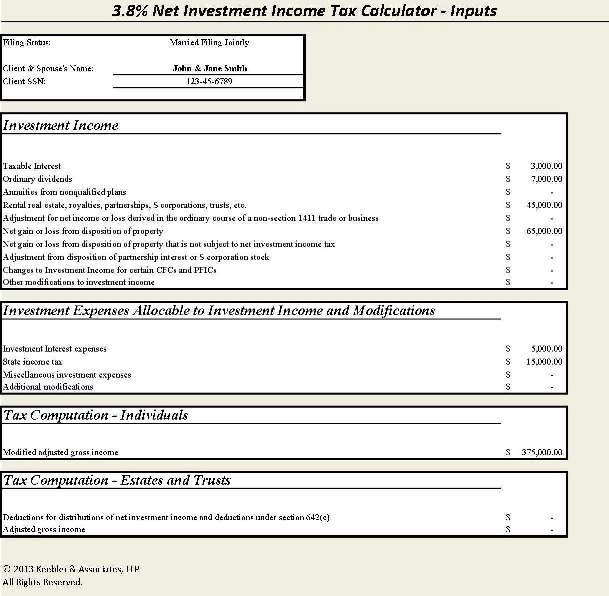

. If your net investment income is 1 or more Form 8960 helps you. NIIT is a 38 tax on the lesser of net investment income or the. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal.

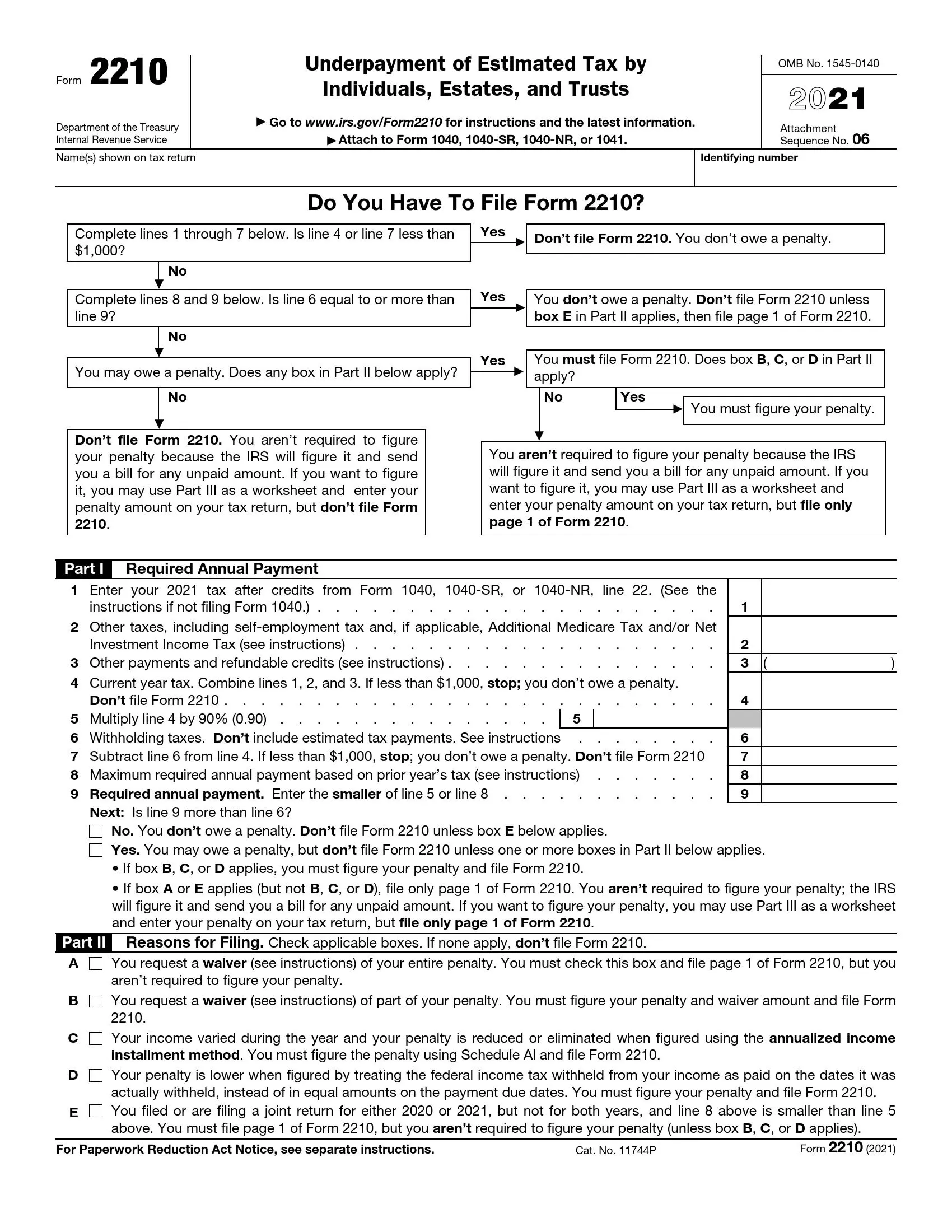

Net Investment Income Tax. A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax NIIT. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an.

Greetings I have a client that was a partner in a partnership that was bought out towards the. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment. A the undistributed net investment income or B the excess if any of.

California election to include net capital gain tax forms are a summary of California tax TAXABLE YEAR 2021 Investment Interest Expense Deduction CALIFORNIA FORM 3526 Attach to Form. Enter your Earned Income Tax Credit from form FTB 3514 California Earned Income Tax Credit line 20. Net Investment Income Tax.

Your IRS Form 1040 can help you calculate your net investment income tax. What is the Net Investment Income Tax Rate. In order to arrive at Net Investment Income Gross Investment Income items described in items 7-11 above is reduced by deductions that.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. The estates or trusts portion of net investment income tax is calculated on Form. Net investment income tax form 8960 The Investment Interest Expense is an itemized deduction on Schedule A so you wouldnt be able to claim this if you are using the.

According to an april 28 2021 congressional research service report the joint committee on. If it turns out that your net investment income is zero or less you dont need to file the form with your taxes. 1 It applies to individuals families estates and trusts.

The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. How to Calculate Net Investment Income Tax. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers.

All About the Net Investment Income Tax. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. The NIIT is equal to 38 of the net investment income of individuals estates and certain trusts.

This paragraph is in the IRS literature. Generally net investment income includes gross income from interest dividends annuities and royalties.

What Is Considered Income For Federal Income Tax Reporting Purposes

1040 2021 Internal Revenue Service

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Tax Calculator Estimate Your Income Tax For 2022 Free

Irs Form 2210 Fill Out Printable Pdf Forms Online

1040 2021 Internal Revenue Service

What Is Irs Form 1040 Schedule 2 Turbotax Tax Tips Videos

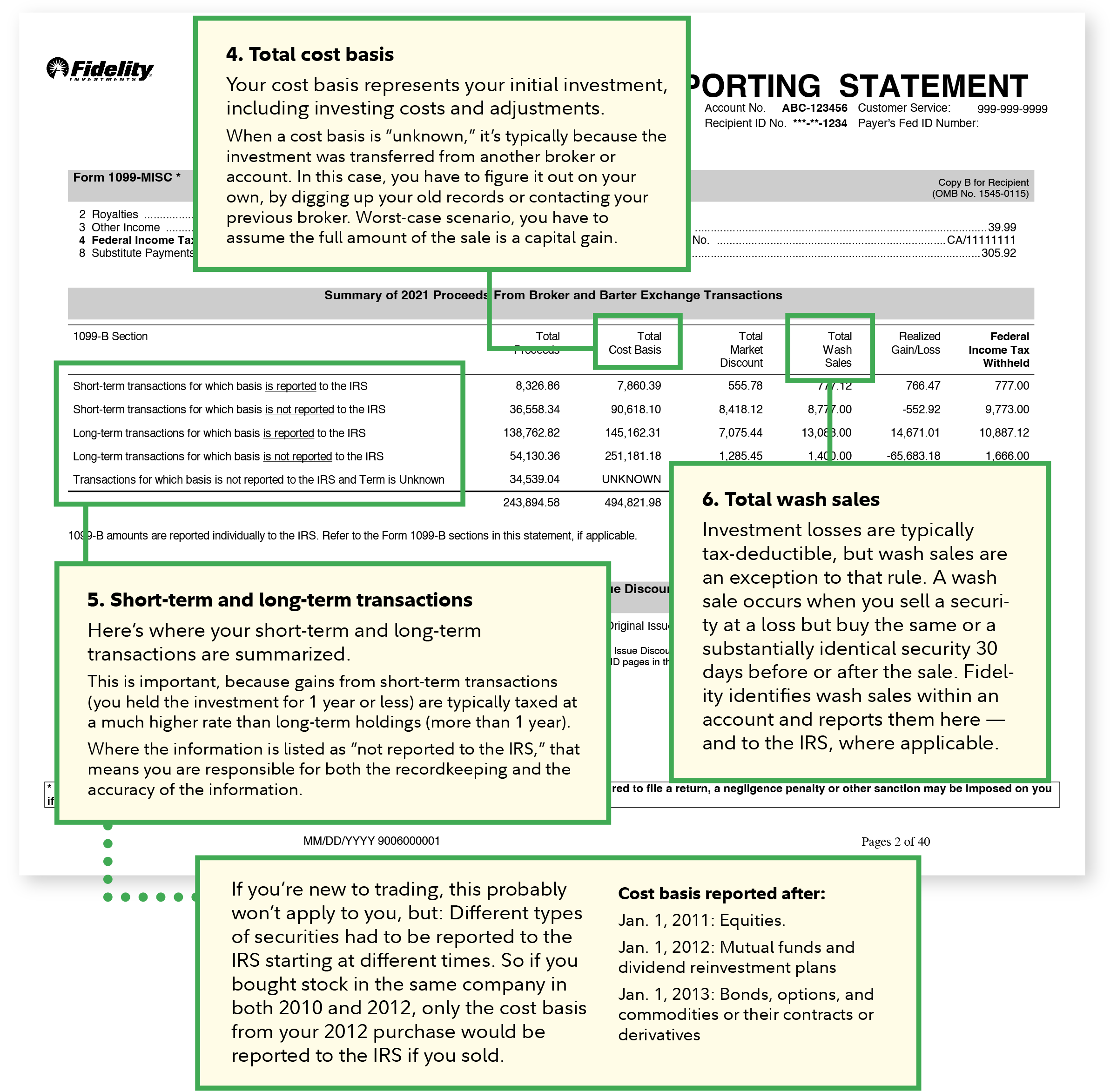

Investment Expenses What S Tax Deductible Charles Schwab

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Understanding The Net Investment Income Tax Wheeler Accountants

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is The Net Investment Income Tax Niit Qsbs Expert

Tax Day 2021 Extended To May 17

Funding Our Nation S Priorities Reforming The Tax Code S Advantageous Treatment Of The Wealthy

Irs Issues Draft Instructions For Net Investment Income Tax Form Wealth Management